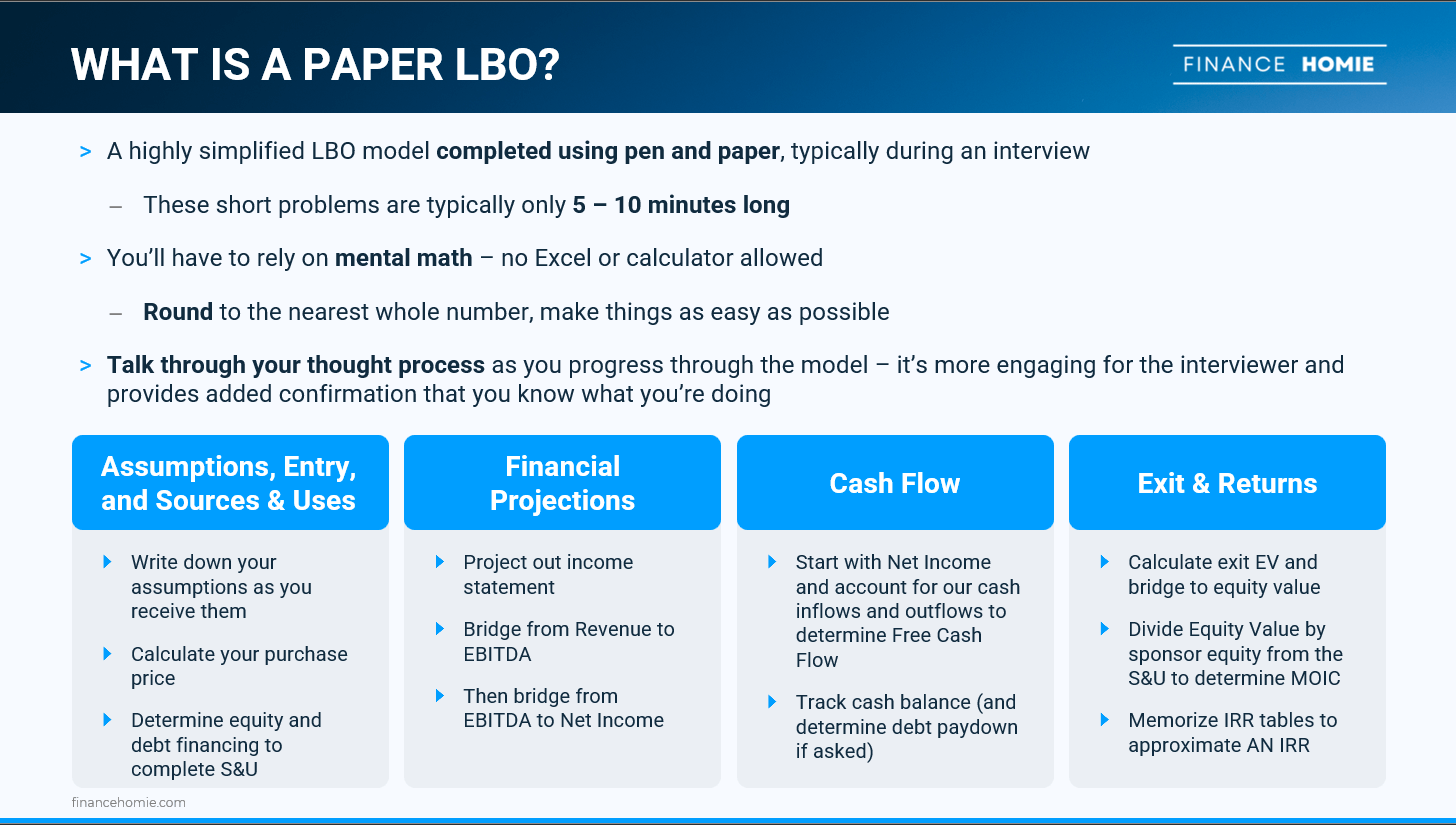

Paper Lbo Exercise . The goal of a paper lbo is to calculate irr and moic and you can’t calculate them without the entry equity check. This step gives you the numbers (i.e. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). Why does anyone bother with paper lbos? Learn the steps to build a paper lbo model in a. Create sources & uses table. Second, project out levered free cash flow. Other firms may have paper or may simply do a fully verbal interview with a simpler example. Exit ebitda and cash) that you need to calculate your exit equity value. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an.

from www.financehomie.com

This step gives you the numbers (i.e. Second, project out levered free cash flow. Exit ebitda and cash) that you need to calculate your exit equity value. Other firms may have paper or may simply do a fully verbal interview with a simpler example. Create sources & uses table. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Why does anyone bother with paper lbos? The goal of a paper lbo is to calculate irr and moic and you can’t calculate them without the entry equity check. Learn the steps to build a paper lbo model in a.

Paper LBO Model Guide & Example

Paper Lbo Exercise This step gives you the numbers (i.e. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. The goal of a paper lbo is to calculate irr and moic and you can’t calculate them without the entry equity check. Why does anyone bother with paper lbos? Create sources & uses table. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). Learn the steps to build a paper lbo model in a. Second, project out levered free cash flow. Other firms may have paper or may simply do a fully verbal interview with a simpler example. This step gives you the numbers (i.e. Exit ebitda and cash) that you need to calculate your exit equity value.

From criticalthinking.cloud

paper lbo case study Paper Lbo Exercise Learn the steps to build a paper lbo model in a. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Create sources & uses table. Second, project out levered free cash. Paper Lbo Exercise.

From www.wallstreetprep.com

The Paper LBO Practice Tutorial Guide Paper Lbo Exercise Other firms may have paper or may simply do a fully verbal interview with a simpler example. Second, project out levered free cash flow. Exit ebitda and cash) that you need to calculate your exit equity value. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. The goal of a. Paper Lbo Exercise.

From www.slideshare.net

Paper LBO model example Paper Lbo Exercise The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Create sources & uses table. Learn the steps to build a paper lbo model in a. Why does anyone bother with paper lbos? This step gives you the numbers (i.e. A paper lbo is a simplified lbo that can be completed. Paper Lbo Exercise.

From multipleexpansion.com

Real Paper LBO Example Multiple Expansion Paper Lbo Exercise Second, project out levered free cash flow. Create sources & uses table. Other firms may have paper or may simply do a fully verbal interview with a simpler example. This step gives you the numbers (i.e. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). Why does anyone bother with. Paper Lbo Exercise.

From www.10xebitda.com

Paper LBO Example WalkThrough for PE Interview (Standard) Paper Lbo Exercise Exit ebitda and cash) that you need to calculate your exit equity value. The goal of a paper lbo is to calculate irr and moic and you can’t calculate them without the entry equity check. Create sources & uses table. Why does anyone bother with paper lbos? Second, project out levered free cash flow. Other firms may have paper or. Paper Lbo Exercise.

From finance-able.com

Paper LBO in 5 Steps The Ultimate Guide (2022) Paper Lbo Exercise Exit ebitda and cash) that you need to calculate your exit equity value. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Second, project out levered free cash flow. Create sources & uses table. A paper lbo is a simplified lbo that can be completed with pen and paper quickly. Paper Lbo Exercise.

From www.peakframeworks.com

The Paper LBO (Private Equity Interview Question) Paper Lbo Exercise Other firms may have paper or may simply do a fully verbal interview with a simpler example. Exit ebitda and cash) that you need to calculate your exit equity value. This step gives you the numbers (i.e. Second, project out levered free cash flow. Create sources & uses table. Learn the steps to build a paper lbo model in a.. Paper Lbo Exercise.

From transacted.io

Paper LBO Model Guide & Example Transacted Paper Lbo Exercise Learn the steps to build a paper lbo model in a. Exit ebitda and cash) that you need to calculate your exit equity value. Other firms may have paper or may simply do a fully verbal interview with a simpler example. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an.. Paper Lbo Exercise.

From www.scribd.com

Paper LBO 2 PDF Paper Lbo Exercise Why does anyone bother with paper lbos? Exit ebitda and cash) that you need to calculate your exit equity value. Second, project out levered free cash flow. Create sources & uses table. Other firms may have paper or may simply do a fully verbal interview with a simpler example. The goal of a paper lbo is to calculate irr and. Paper Lbo Exercise.

From www.amazon.co.uk

The Paper LBO Proven Methods for Acing the Private Equity Interview Paper Lbo Exercise This step gives you the numbers (i.e. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). Why does anyone bother with paper lbos? The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Exit ebitda and cash) that you need to. Paper Lbo Exercise.

From www.scribd.com

Paper LBO 1 PDF Paper Lbo Exercise Learn the steps to build a paper lbo model in a. This step gives you the numbers (i.e. Exit ebitda and cash) that you need to calculate your exit equity value. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). Why does anyone bother with paper lbos? The goal of. Paper Lbo Exercise.

From multipleexpansion.com

Paper LBO StepbyStep Example Multiple Expansion Paper Lbo Exercise This step gives you the numbers (i.e. The goal of a paper lbo is to calculate irr and moic and you can’t calculate them without the entry equity check. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Create sources & uses table. Why does anyone bother with paper lbos?. Paper Lbo Exercise.

From courses.corporatefinanceinstitute.com

LBO Model Leveraged Buyout LBO Modeling Course Paper Lbo Exercise The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). This step gives you the numbers (i.e. Learn the steps to build a paper lbo model in a. Exit ebitda and cash). Paper Lbo Exercise.

From religionisland.doralutz.com

How To Build A Lbo Model Religionisland Doralutz Paper Lbo Exercise Why does anyone bother with paper lbos? Learn the steps to build a paper lbo model in a. This step gives you the numbers (i.e. Second, project out levered free cash flow. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Exit ebitda and cash) that you need to calculate. Paper Lbo Exercise.

From getofficehours.com

Conduct a Paper LBO Analysis StepbyStep Guide Paper Lbo Exercise Learn the steps to build a paper lbo model in a. Create sources & uses table. Why does anyone bother with paper lbos? A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). Second, project out levered free cash flow. The goal of a paper lbo is to calculate irr and. Paper Lbo Exercise.

From www.peakframeworks.com

The Paper LBO (Private Equity Interview Question) Paper Lbo Exercise Learn the steps to build a paper lbo model in a. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. A paper lbo is a simplified lbo that can be completed with pen and paper quickly (ten minutes tops). Second, project out levered free cash flow. Why does anyone bother. Paper Lbo Exercise.

From multipleexpansion.com

Paper LBO StepbyStep Example Multiple Expansion Paper Lbo Exercise The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Create sources & uses table. The goal of a paper lbo is to calculate irr and moic and you can’t calculate them without the entry equity check. Why does anyone bother with paper lbos? Other firms may have paper or may. Paper Lbo Exercise.

From www.youtube.com

How to do a Paper LBO (MUST Know for Private Equity) YouTube Paper Lbo Exercise Other firms may have paper or may simply do a fully verbal interview with a simpler example. Second, project out levered free cash flow. The paper lbo is a common exercise completed during the private equity interview process, for which we’ll provide an. Learn the steps to build a paper lbo model in a. A paper lbo is a simplified. Paper Lbo Exercise.